In today’s world, logistics and cargo insurance are a standard part of business, managed by digital technology and automated systems. But imagine Houston in the 19th century, a time when the city was just beginning to grow into a major trade hub. Back then, insurance was a completely different story: manual, risky, and incredibly important for anyone in business. Let’s take a look at how it all worked on houston1.one.

The Beginning

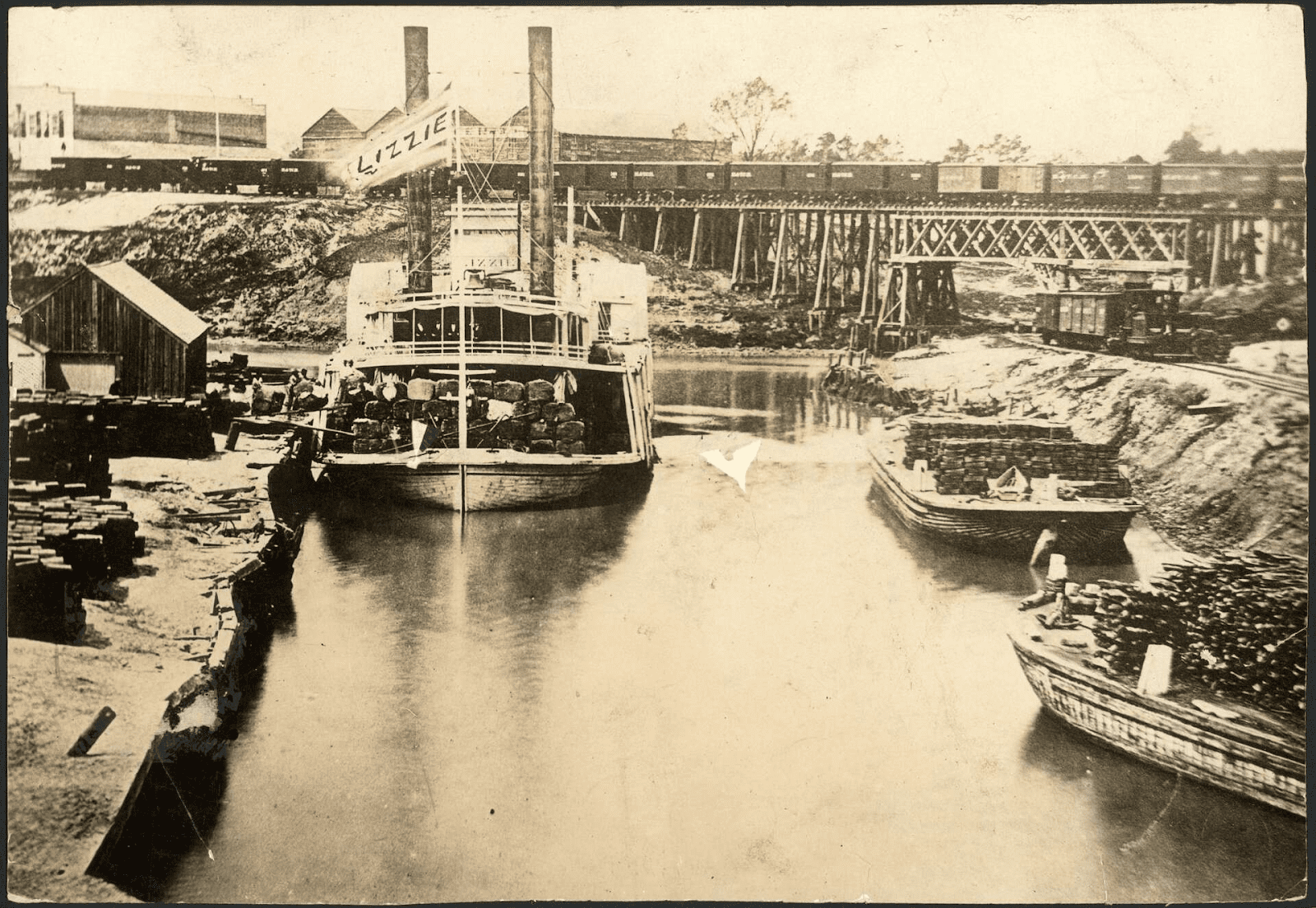

Before the mid-19th century, cargo insurance in Houston was primarily a matter of trust. Owners of goods shipped on Buffalo Bayou or by rail would arrange for compensation directly with carriers or other merchants. If a shipment was lost due to a storm, a fire on a boat, or an attack, they could only rely on verbal promises. This was a high-risk approach that often led to financial ruin.

The situation began to change with the arrival of the first insurance agents. One of these pioneers was John A. Dubois, who opened his agency in Houston in the 1850s. He represented large insurance companies from New York and New Orleans. Instead of verbal agreements, Dubois offered formal policies. These documents contained a clear list of risks the cargo was insured against, such as:

- flooding and water damage;

- fires on vessels;

- theft and piracy.

These policies were the first step toward a more professional insurance market in Texas.

Paperwork, Seals, and Risk

The system for insuring cargo in the 19th century was a painstaking process. A cargo owner would come to the insurance agent with a description of the goods, their value, and the shipping route. The agent would then assess the risks, considering the season (storms), the route (dangerous river sections), and the type of cargo (for example, cotton was highly flammable and pricier to insure). Thereafter, he would calculate the insurance premium—the amount the client had to pay.

To give you a better idea, here are a few examples:

- Shipping cotton. A valuable but very risky cargo. The insurance premium for a bale of cotton shipped from Houston to Galveston could be up to 5% of its value.

- Transporting metal. A less risky cargo since it didn’t burn and was resistant to water. The premium was significantly lower, sometimes less than 1% of the value.

All details were written by hand in a special ledger and verified with a seal. In the event of a claim, the agent would personally investigate the circumstances, talk to witnesses, and assess the damage to determine the payout amount. This was a process based not on algorithms, but on the experience and integrity of specific individuals.

The Dark Side of Insurance

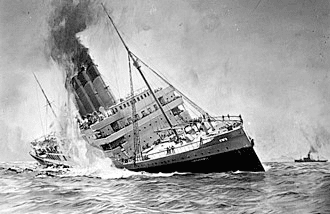

Insurance back then wasn’t just about trust; it was also a fertile ground for fraud. Because the process was far from modern automation, it depended heavily on the human factor. This created numerous opportunities for manipulation and deception. One of the most common scams was “staged” sinking—when dishonest carriers would deliberately scuttle cargo to collect the insurance payout. They would hide small holes or improperly load a vessel so it would capsize in the first major storm.

To combat these issues, insurance agents like John Dubois relied on their reputation and their network of informants. They had trusted captains who could vouch for a ship’s true condition and local dockworkers who would report suspicious activities. In the case of large insurance claims, agents often hired private detectives to uncover the real reasons for the lost cargo. This fight against fraud was an integral part of an insurer’s job back then, showing that even in the 19th century, business in Houston was full of challenges where success required not only capital but also vigilance.

The Evolution of Insurance

As Houston grew into a major port city, so did the insurance market. By the end of the century, new insurance companies had appeared, and competition began to drive down prices. Railroads and steamboats became more reliable, which also affected the cost of insurance.

This period was a transition that led to modern insurance. The old methods, based on handwritten policies and personal assessments, were replaced by standardized forms and fixed rates. The lessons learned by Houston’s insurers in the 19th century laid the groundwork for today’s cargo protection system, which now spans the globe, but its core principles—risk assessment and damage compensation—have remained unchanged.

| Aspect | 19th Century Insurance | Modern Insurance |

| Process | Manual, based on verbal agreements and handwritten policies. | Automated, with electronic databases and online applications. |

| Risk Assessment | Agent’s personal experience, knowledge of the route and weather. | Statistical models, data analysis, and tracking technology. |

| Documentation | Ledgers, handwritten documents with seals. | Electronic policies, digital signatures. |

| Regulation | Informal, based on reputation. | Clear legislation and government regulation. |