JPMorgan Chase is the largest banking corporation by assets. This bank belongs to the so-called Big Four of the largest banks in the United States. The bank’s total assets at the end of 2024 were estimated at almost $4 trillion. JPMorgan has branches all over the world and is one of the largest financial institutions. It has a centuries-old history, interesting traditions and the trust of depositors. Discover how the bank’s branch in Houston developed. Read more on houston1.one.

History of creation: from water supply to a large bank

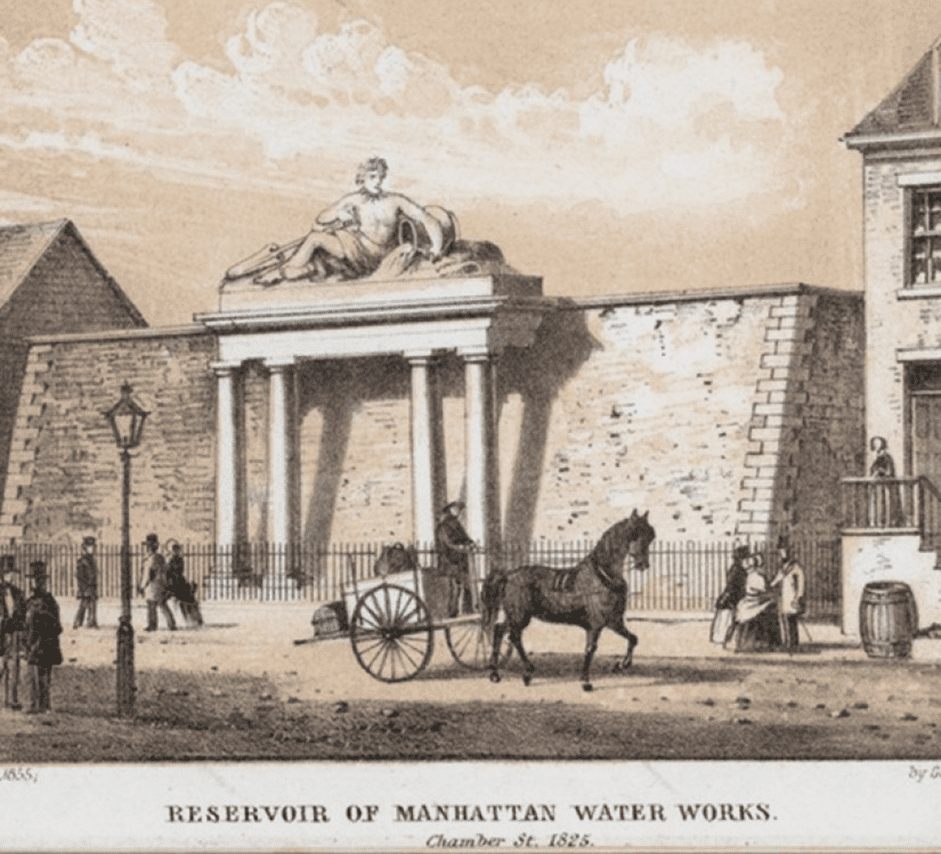

The banking holding did not begin its activities as a financial institution. At first, it was a company that provided New York with clean water. This enterprise was called the Manhattan Company, which was officially founded in 1799 by Aaron Burr. Having earned the starting capital, the firm radically changed the vector of its activities to the banking sector and was renamed the Bank of the Manhattan Company. In 1955, this financial institution was acquired by another giant in the financial sphere. The new institution that absorbed the Manhattan Company was Chase National Bank. To preserve both well-known brands, the merged bank was called Chase Manhattan Bank. This corporation was owned by the Rockefeller family. Over the course of a quarter of a millennium, the bank merged or absorbed more than 1,200 similar institutions.

Among all the institutions that were merged, it is worth learning about the world’s first billionaire bank, which also became part of this corporation. We are talking about J.P. Morgan & Co. It also has a long history and is known for providing the US government with $62 million in gold in 1895. Later, the state thanked the bank for this act, granting it a monopoly on issuing bonds, government obligations to pay for military expenses. After World War I, this gift brought the institution enormous profits. In 1930, due to the laws adopted, J.P. Morgan & Co. was forced to split and some of the partners formed Morgan Stanley.

In 2000, a truly grandiose event worthy of the millennium took place in the banking sector of the United States. Chase Manhattan Corporation and J.P. Morgan & Co. merged into one holding company. As a result, one of the largest world banks was formed, JPMorgan Chase.

Houston branch of JPMorgan Chase

Houston has always been an attractive city for investment. Many headquarters of various large energy companies are concentrated here, as well as many others. The presence of banks is simply necessary. Therefore, there is fierce competition in the city for the right to hold, preserve and increase capital. The Houston branch of JPMorgan Chase entered the market in 2004. The world name and attractive conditions allowed the bank to almost immediately become a key financial player in the region. Having created comfortable conditions for cooperation for large corporate clients from the oil and gas industry, small businesses and individuals, the bank became a leader in the financial industry of the entire region in the first year of operation in Houston.

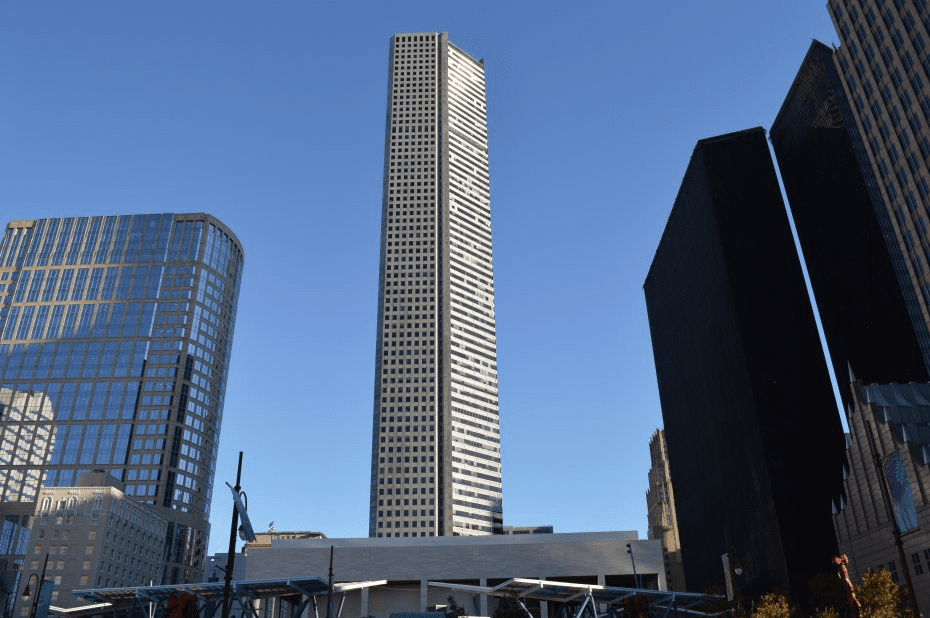

The central office in Houston is located in the tallest building in the city, JPMorgan Chase Tower. This tower is a landmark for the entire USA. The fact that the board of directors chose it for the main branch is also very symbolic. It is not difficult to read the subtext of this choice: we are located in one of the tallest buildings in the USA, so we are the best bank in the country.

These are important symbols. JPMorgan Chase Bank is indeed one of the recognized leaders and deserves this. The Houston branch of the bank serves and finances various energy projects, including the latest eco-trends in alternative energy production. In addition to this sector, the bank finances technological startups, invests significantly in real estate construction and contributes to many other areas of modern progress in the city.

JPMorgan Chase also actively invests in community projects. The bank has a number of programs to help small businesses develop. Among the services are initiatives to help representatives of national minorities and women. The bank is actively involved in charitable events in Houston. It supports educational programs not only in the city but also in the entire region. Qualified bank employees have developed programs to teach children financial literacy and initiatives to combat poverty.

The Houston branch of JPMorgan Chase is one of the first to introduce digital services for ordinary residents of the city. The bank was among the first to introduce mobile banking and digital payments for Houston customers. JPMorgan Chase is also the largest employer in Houston.

Scandals and fines

However, the story did not go without scandals. Like other regional offices, the Houston branch was involved in the consequences of the mortgage crisis of 2008. This situation, also known as the financial crisis, was one of the most severe economic disasters in US history. It all started with good intentions, so that everyone who wanted to get a home could get it. Therefore, mortgage loans were issued even to customers with low solvency.

According to the snowball principle, they started processes. The banks that issued these loans actively securitized them, turning them into financial instruments that were sold to investors. In turn, credit agencies gave high ratings to risky securities, which led to their excessive popularity. This led to a sharp decline in real estate prices. When prices began to fall, borrowers lost the ability to service loans and banks suffered huge losses. The result was a nationwide and a global crisis.

JPMorgan Chase, as one of the largest banks in the United States, played a key role in the mortgage lending market. In addition to colossal losses, the bank fell under litigation that lasted 5 years. The bank was accused of selling risky mortgage securities and participating in the creation of a bubble in the housing market. According to the court’s decision, JPMorgan Chase had to pay a record fine of $13 billion. This amount also included $4 billion to compensate affected borrowers.

For Houston, the consequences of the crisis were less devastating than for other regions of the United States, such as Florida or Nebraska, where recession lasted for a long time. Still, it became a lesson in the importance of responsible lending and financial market regulation.

The next major scandal with JPMorgan Chase arose in 2020. Bank employees were accused of so-called spoofing, manipulation of the financial market. As a result, the court issued a verdict according to which the bank had to pay a fine of $920 million.

Regional significance of the bank

Despite all the troubles, JPMorgan Chase in Houston remains one of the main financial institutions, serving clients through numerous branches and providing a wide range of financial services. The bank is a key element of the city’s economic life, combining the rich experience of a global bank with an individual approach to the needs of Houston clients. Despite all the scandals related to financial fraud, Houstonians trust the bank and continue to cooperate with it.